Asset Allocation Weekly (December 2, 2016)

by Asset Allocation Committee

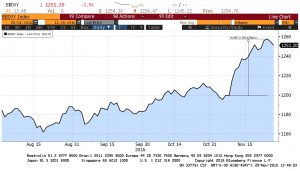

Last week, we discussed the likely implications of President-elect Trump’s policies on the debt markets. This week, we will look at the impact on the dollar. Since the election, the dollar has generally moved higher.

Using the Bloomberg dollar index, a broad-based currency measure, the dollar rose nearly 5% after the election. There are a number of arguments behind the rise. Trump campaigned for fiscal expansion, which could include both infrastructure spending and tax cuts. The expected fiscal expansion could lead to tighter monetary policy and this particular combination is usually thought to be bullish for the dollar.

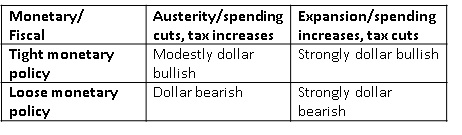

This box describes the expected outcomes from the interplay of fiscal and monetary policy. This is a rough guide; the actual outcomes are mostly driven by the degree of policy adjustment. In the early 1980s, the combination of real fed funds of nearly 8.5% and a fiscal deficit of almost 6% of GDP led to a very strong dollar (the “Volcker dollar”). Market behavior may be anticipating a repeat of this outcome.

However, this assumption depends on the FOMC moving to tighter policy, almost a “hard money” stance of the Volcker years. Simply put, we don’t know for sure whether this will be the outcome. We believe that there is a political struggle in the Trump administration between the GOP establishment and right-wing populists. To personalize the sides, we view it as Speaker Paul Ryan versus Steve Bannon. The FOMC has two open governor positions. If Ryan’s wing of the party wins, we will likely see the Fed change into a hard money central bank, which is a quadrant two outcome on the above table. On the other hand, if Bannon’s wing wins, it is possible that we will see doves appointed to the Federal Reserve. That scenario could lead to a quadrant four outcome, which would be quite different from what the market expects.

The policy situation isn’t the only supporting factor for a stronger dollar. It is estimated that over $2.0 trillion is held by U.S. companies offshore in order to avoid corporate taxes. If corporate taxes are reformed, at least some of this money will come back home which would lift the dollar. If Trump were to put up trade barriers as promised, the current account deficit would shrink, which would reduce the supply of dollars and boost the dollar’s value as well. Thus, for now, we expect the dollar to get the benefit of the doubt and it will likely continue to appreciate.

What is hurt by a stronger dollar? The two asset classes most at risk from dollar strength are commodities and emerging markets. Since the election, commodity prices have been mixed; the Bloomberg commodity index is actually higher since the election, up 2.7%. Industrial metals are up 6.4% over this time period and energy is up 5.9%. At the same time, gold is down 7.4%. The MSCI Emerging Market Index is down 2.8% since the election. If the dollar continues to appreciate, these asset classes will likely face further declines.